Unlocking the Power of the S&P 500: A Guide to Investing in the US Stock Market

Table of Contents

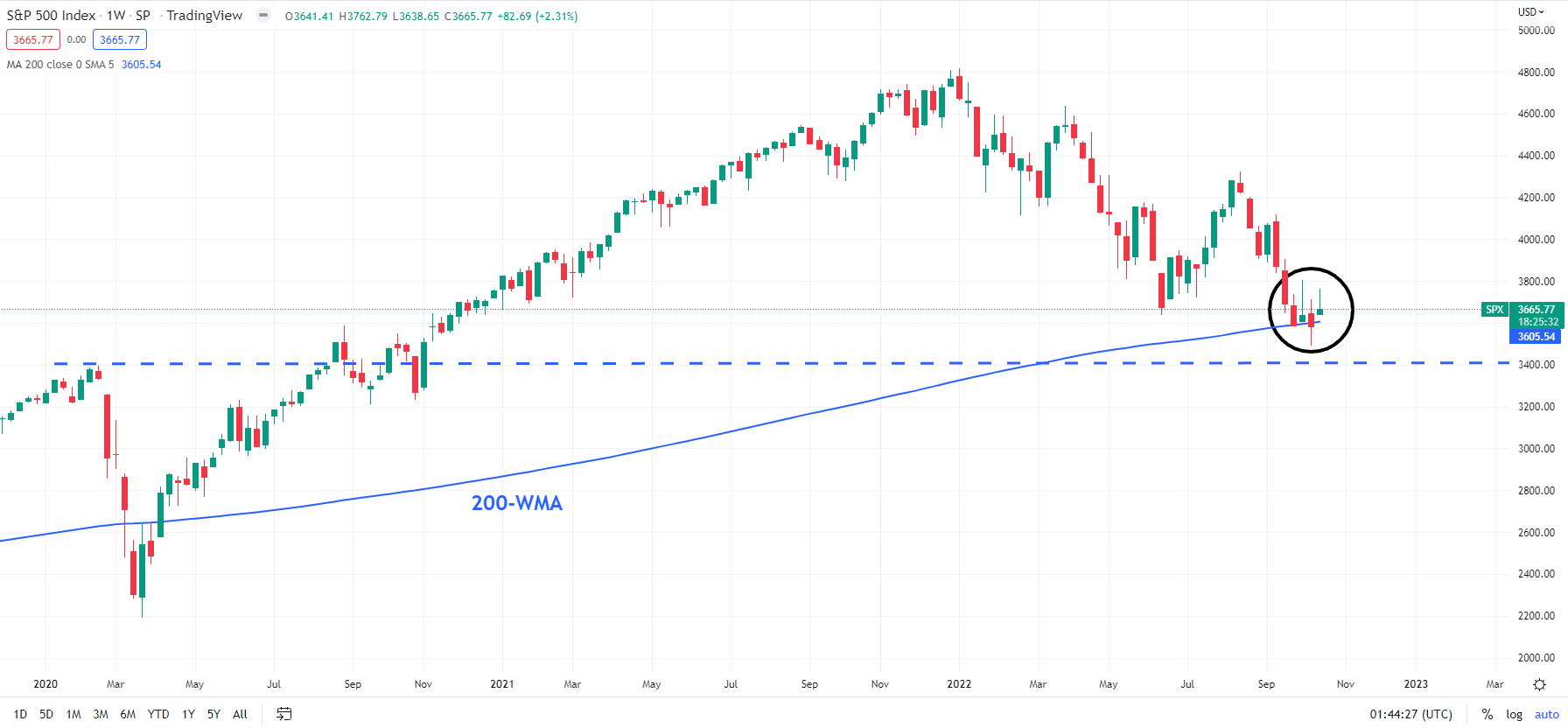

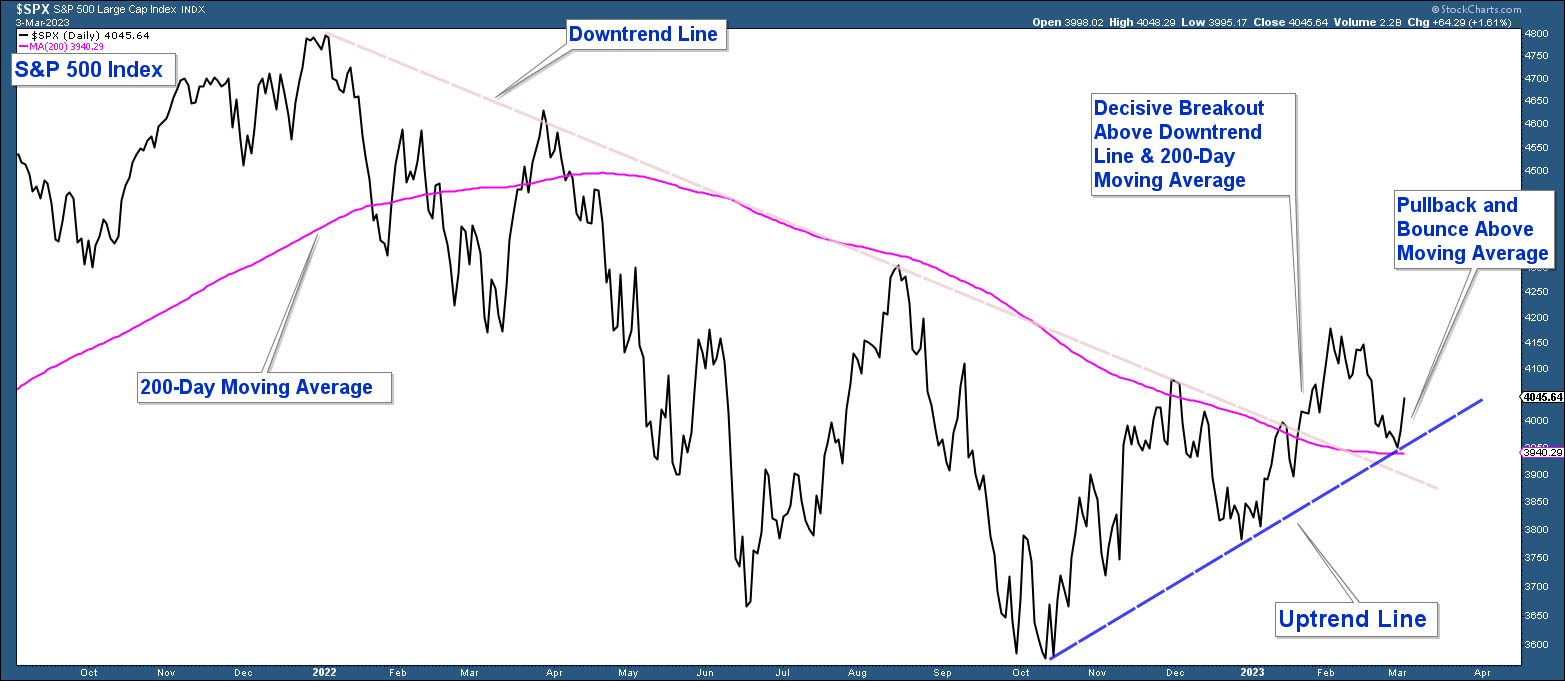

- S&P 500 and Nasdaq Composite Index Technical Outlook: Is the Down Trend ...

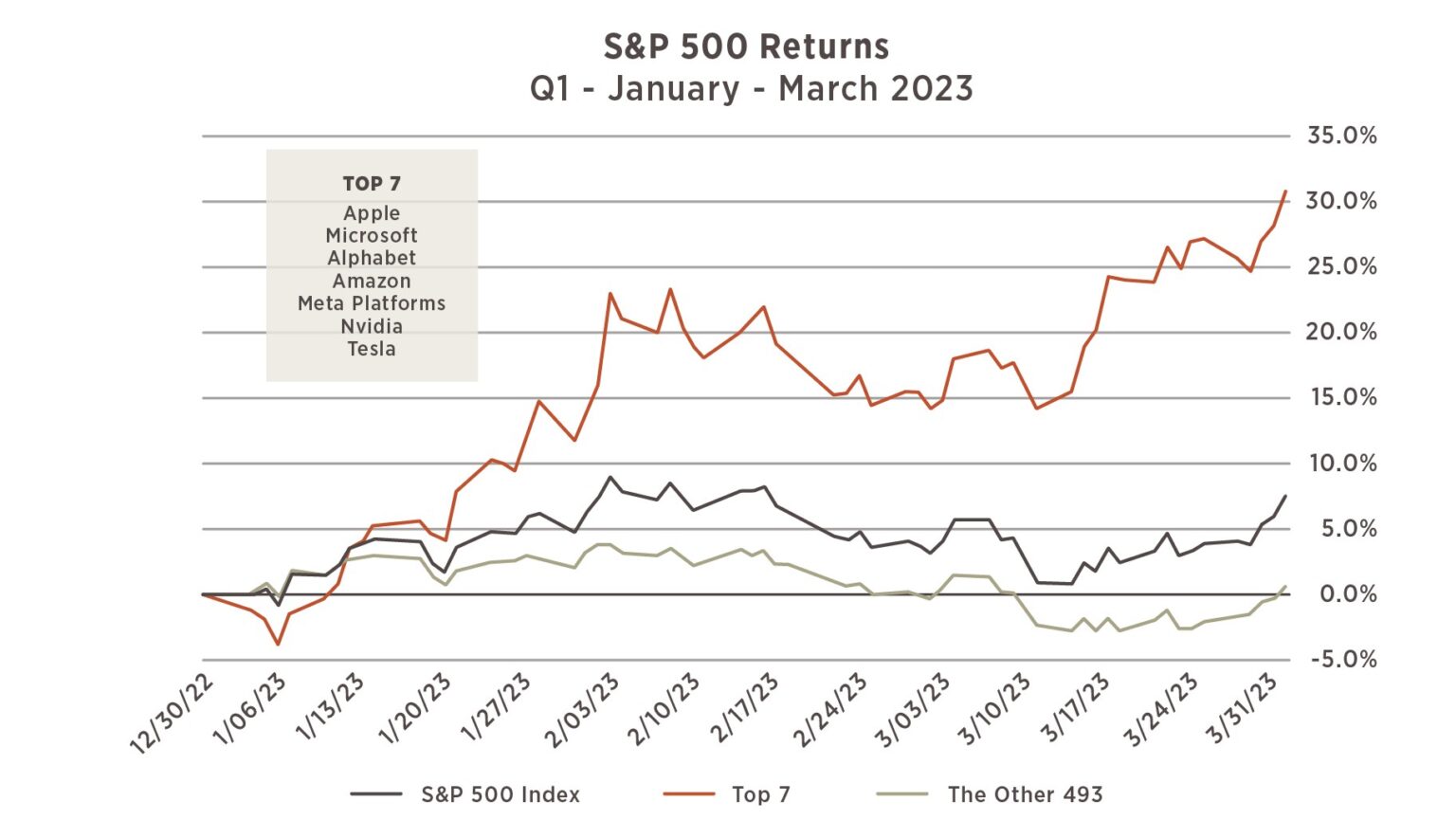

- What is Driving S&P 500 Returns? - 6 Meridian

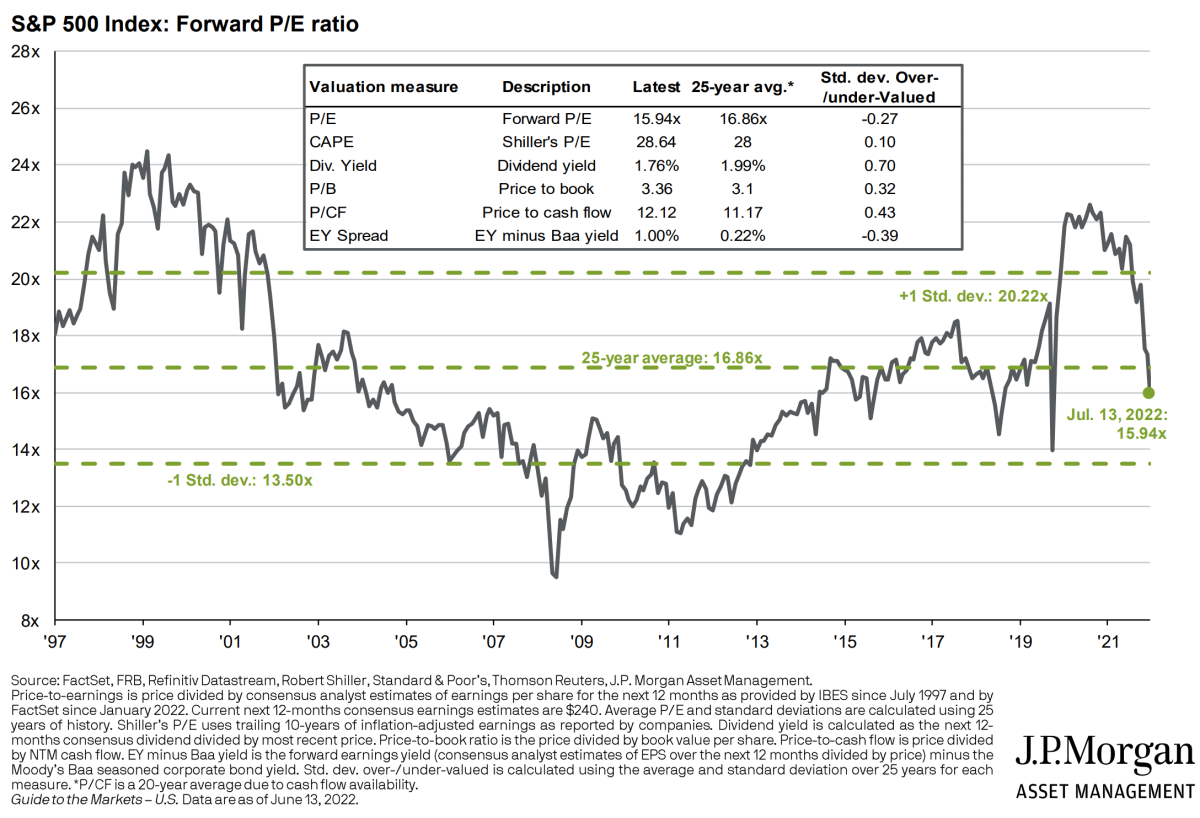

- S&P 500 Forward P/E Ratio Falls Below 10-Year Average Of, 59% OFF

- S&P 500 Still Bullish Despite February Pullback | Investing.com

- W.A.S.P. ANNOUNCE THE 7 SAVAGE DELUXE 8LP BOXSET FROM THEIR ‘CAPITOL ...

- S P 500 Annual Returns Chart - Ponasa

- S trap vs P trap: 5 Differences You Need to Know Now

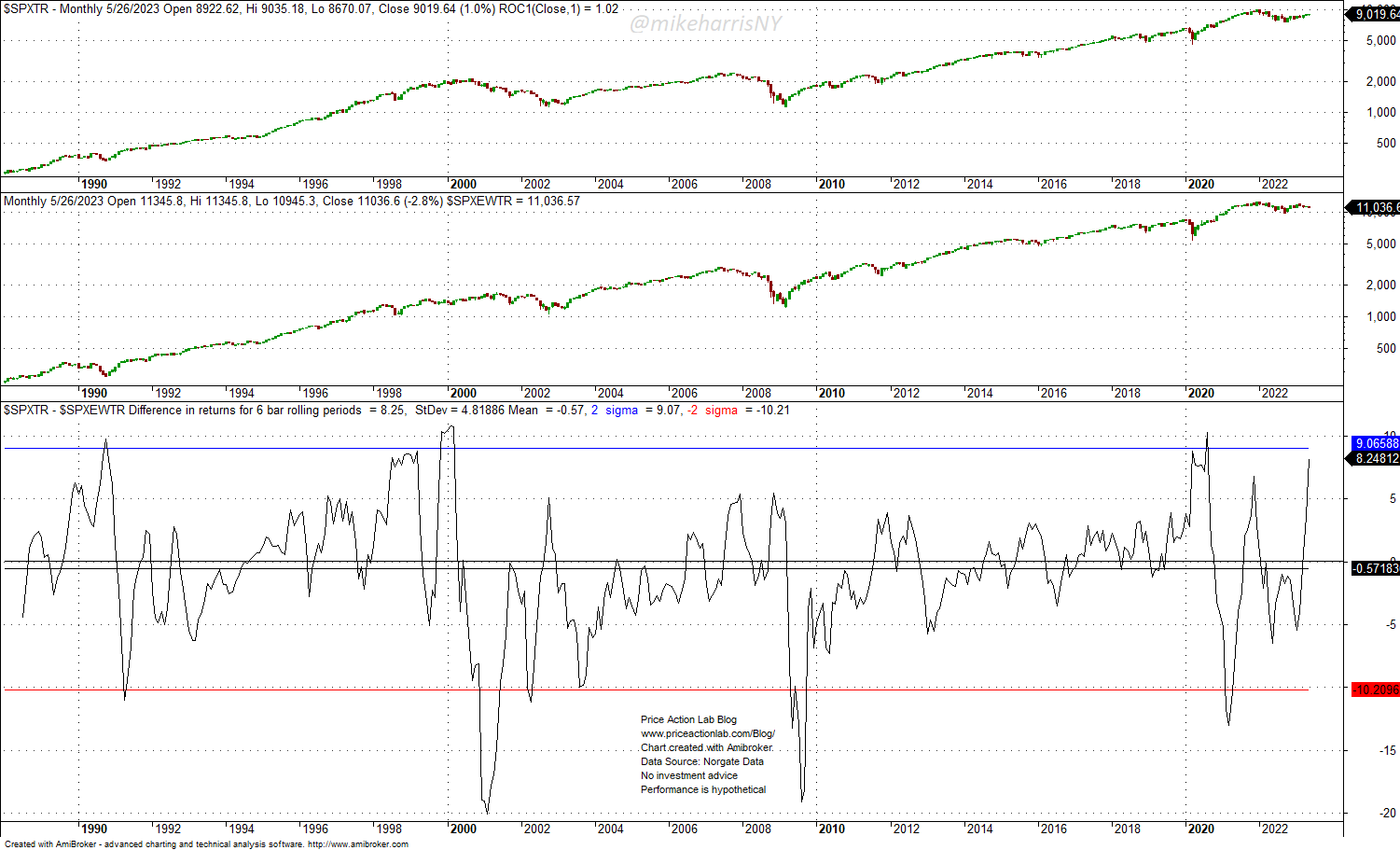

- Relative Performance Of Market-Cap Weighted And Equal-Weight S&P 500 ...

- S P 500 Chart Stock Market Crash These Charts Reveal - vrogue.co

- Indeks S&P 500 Memulai Hari Perdagangan Terakhir Hijau Di Atas 4.200

What is the S&P 500 Index?

How is the S&P 500 Index Calculated?

:max_bytes(150000):strip_icc()/gH8Ic-one-year-nbsp-of-rate-hikes-impact-on-the-s-amp-p-500-nbsp-1-90987846c62546afbabc571948c28c62.jpg)

Why is the S&P 500 Index Important in Investing?

The S&P 500 Index is important in investing for several reasons: Benchmarking: The S&P 500 Index is widely used as a benchmark for the performance of the US stock market. It provides a way to measure the performance of a portfolio or a fund against the overall market. Diversification: The S&P 500 Index includes companies from a wide range of industries, making it a diversified investment option. Low Risk: The S&P 500 Index is considered a low-risk investment option because it is a broad market index that is less volatile than individual stocks. Easy to Invest: The S&P 500 Index can be invested in through a variety of financial products, including index funds, exchange-traded funds (ETFs), and mutual funds.

How to Invest in the S&P 500 Index

There are several ways to invest in the S&P 500 Index, including: Index Funds: Index funds are a type of mutual fund that tracks the performance of the S&P 500 Index. Exchange-Traded Funds (ETFs): ETFs are a type of investment fund that trades on a stock exchange like a stock. Individual Stocks: Investors can also invest in the individual stocks that make up the S&P 500 Index. In conclusion, the S&P 500 Index is a powerful tool for investors who want to gain exposure to the US stock market. Its importance in investing lies in its ability to provide a benchmark for the performance of the market, its diversification benefits, and its low risk. By understanding what the S&P 500 Index is and how it works, investors can make informed decisions about their investment portfolios and achieve their long-term financial goals.Keyword: S&P 500 Index, investing, stock market, US economy, benchmark, diversification, low risk, index funds, ETFs, individual stocks.