The world of trading and investing is filled with colorful terms and phrases, each designed to convey complex concepts in a more accessible way. One such term that has garnered attention, particularly during periods of market volatility, is the "dead cat bounce." This phenomenon, while morbid in name, provides valuable insights into market dynamics and can be a crucial tool in a trader's arsenal. In this article, we will delve into what a dead cat bounce is, its implications for traders, and how to incorporate this knowledge into your trading strategy.

What is a Dead Cat Bounce?

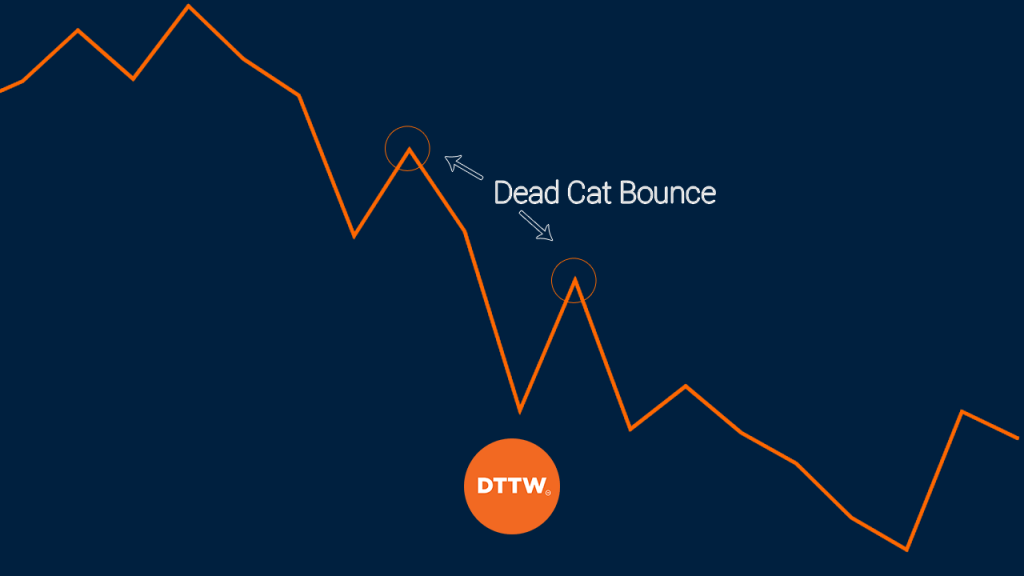

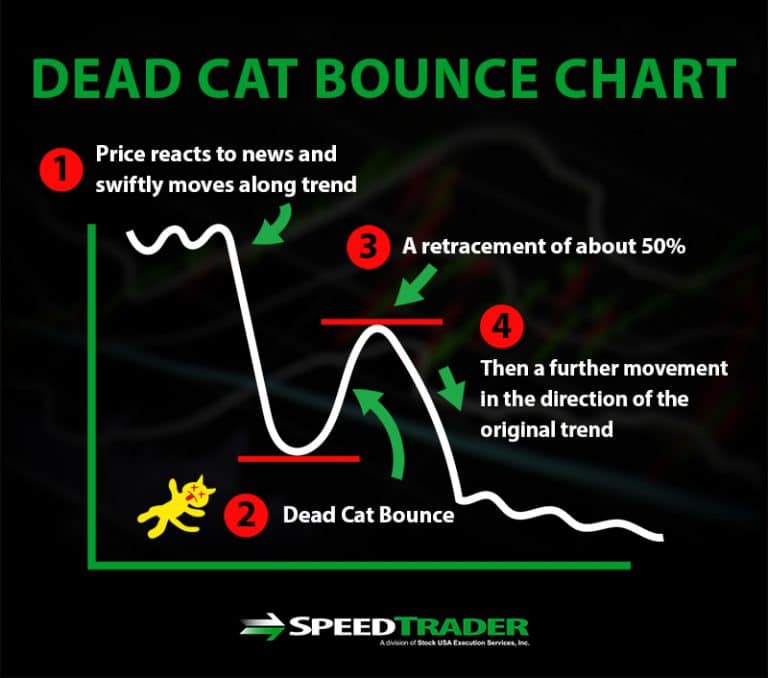

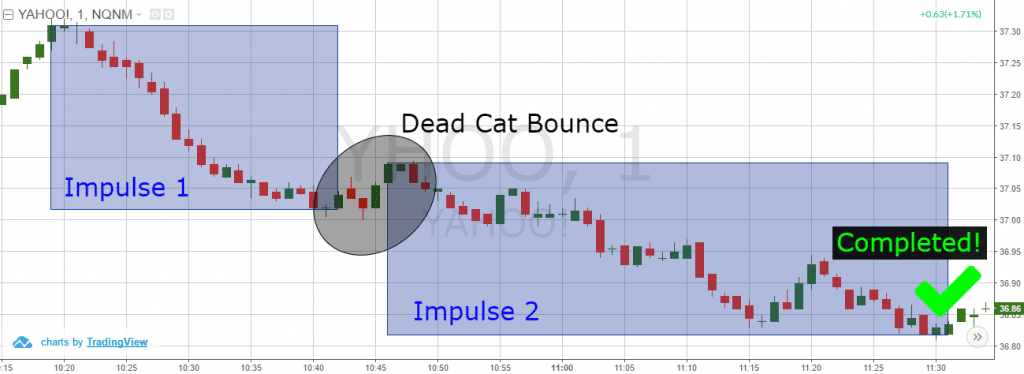

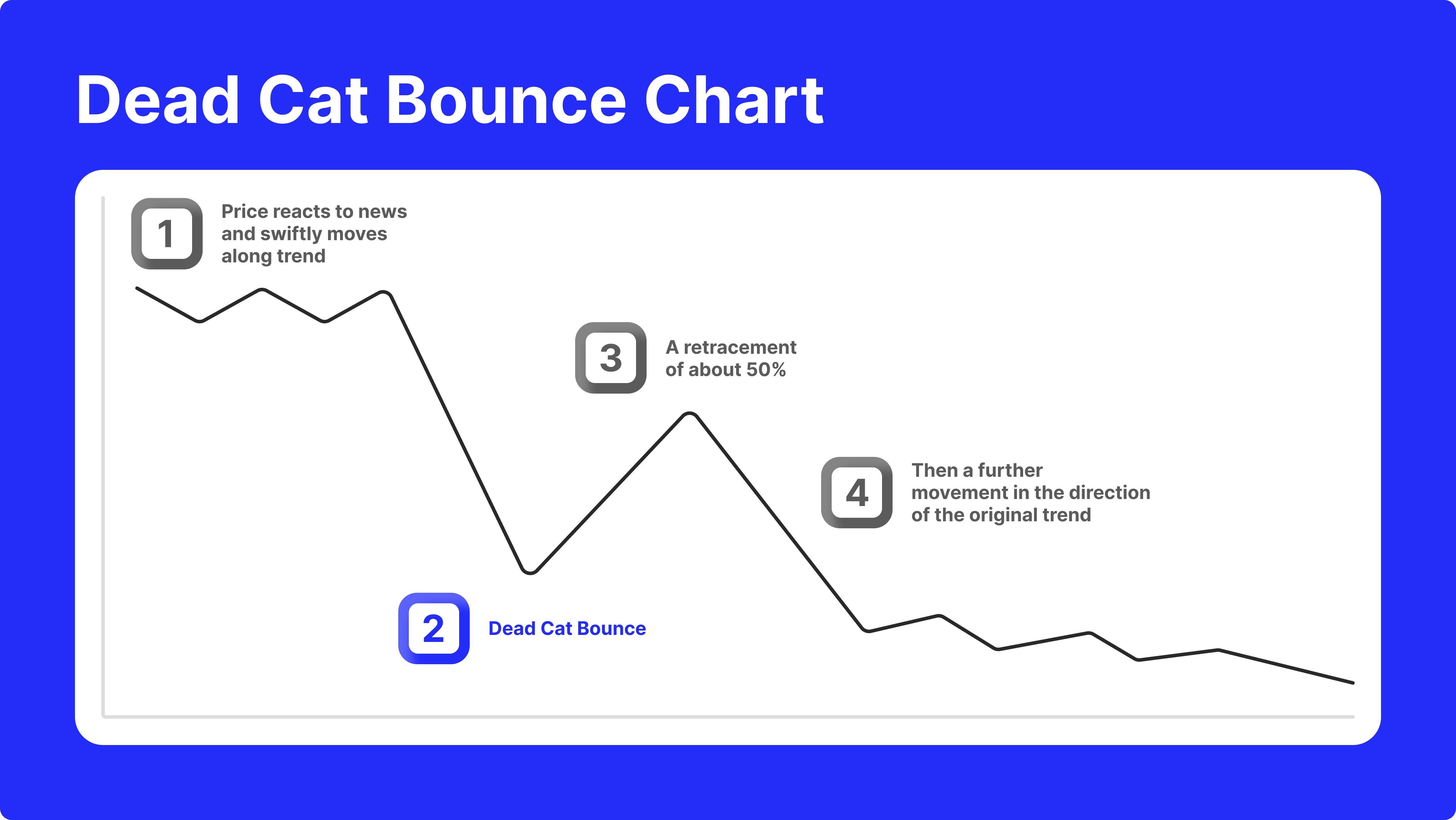

A dead cat bounce refers to a brief, small recovery in the price of a stock or commodity after a significant decline. The term is derived from the idea that even a dead cat will bounce if dropped from a great height, implying that the bounce is not a sign of life or vitality but rather a natural consequence of the fall. This phenomenon is often seen in financial markets where a stock that has been in a downtrend experiences a short-lived rebound before resuming its downward trajectory.

Identifying a Dead Cat Bounce

Identifying a dead cat bounce is crucial for traders as it can significantly impact their investment decisions. Here are some key indicators to look out for:

-

Sudden Price Drop: A significant and rapid decline in the price of a stock or asset.

-

Brief Recovery: A short-lived increase in price following the drop.

-

Lack of Volume: The recovery is often characterized by low trading volume, indicating a lack of conviction among buyers.

-

Technical Indicators: Tools like moving averages, RSI (Relative Strength Index), and trend lines can help confirm if the bounce is a dead cat bounce.

How to Trade a Dead Cat Bounce

Trading a dead cat bounce requires a combination of technical analysis, risk management, and a clear understanding of market psychology. Here are some strategies:

-

Short Selling: If you identify a dead cat bounce, you can short sell the stock, anticipating that the price will continue to fall after the brief recovery.

-

Stop Loss: Setting a stop loss at the peak of the bounce can help limit losses if the market moves against your prediction.

-

Wait for Confirmation: Before entering a trade, wait for confirmation from technical indicators that the bounce is indeed a dead cat bounce.

-

Stay Informed: Keep up with market news and trends, as external factors can quickly change the outlook for a stock.

The dead cat bounce is a fascinating market phenomenon that offers traders a unique opportunity to profit from market volatility. By understanding the characteristics of a dead cat bounce and incorporating this knowledge into your trading strategy, you can make more informed decisions and potentially increase your returns. However, trading always involves risk, and it's essential to approach the markets with a disciplined and well-researched approach. Whether you're a seasoned trader or just starting out, recognizing and trading dead cat bounces can be a valuable addition to your toolkit.

Remember, the key to successful trading is not just about identifying opportunities but also about managing risk and staying adaptable in a rapidly changing market environment. As you navigate the complex world of trading, keep in mind that knowledge, combined with experience and a keen eye for market trends, is your best asset.

For the latest market analysis and to stay updated on financial news, visit Investing.com. Enhance your trading skills with the latest insights and expert advice.