Understanding 2025 Medicare Premiums and Deductibles: A Comprehensive Guide

Table of Contents

- 2024 Medicare IRMAA Explained - YouTube

- How High-Net-Worth Retirees Can Prepare For Medicare IRMAA

- Understanding IRMAA: How Income Affects Your Medicare Premiums - Policy ...

- Medicare Part D IRMAA 2025 - Crowe & Associates

- What is IRMAA? - FerrettoYoung Eldercare

- Medicare IRMAA 2022 Brackets: Information on Plans and premium ...

- Facts about IRMAA … and some editorializing. | BRIO Financial Planning

- Medicare's 2023 IRMAA Brackets And Part B Premiums Change | FedSmith.com

- Facts about IRMAA … and some editorializing. | BRIO Financial Planning

- Making Sense of Medicare IRMAA, a Universally Confusing Topic ...

2025 Medicare Part B Premiums

2025 Medicare Part B Deductible

2025 Medicare Part A Premiums and Deductibles

Most Medicare beneficiaries do not pay a premium for Medicare Part A, as they or their spouse have worked and paid Medicare taxes for at least 10 years. However, those who do not qualify for premium-free Part A will pay a premium of up to $506 per month in 2025. The Medicare Part A deductible for 2025 is $1,556, an increase from the 2024 deductible.

IRMAA: Income-Related Monthly Adjustment Amount

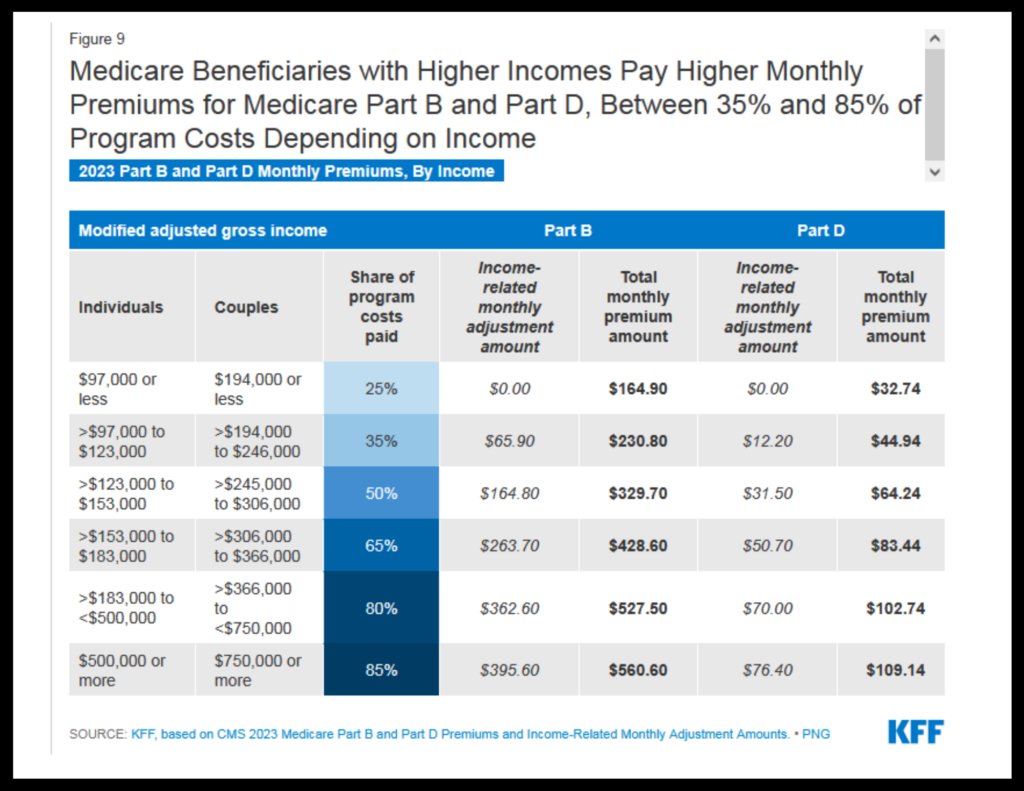

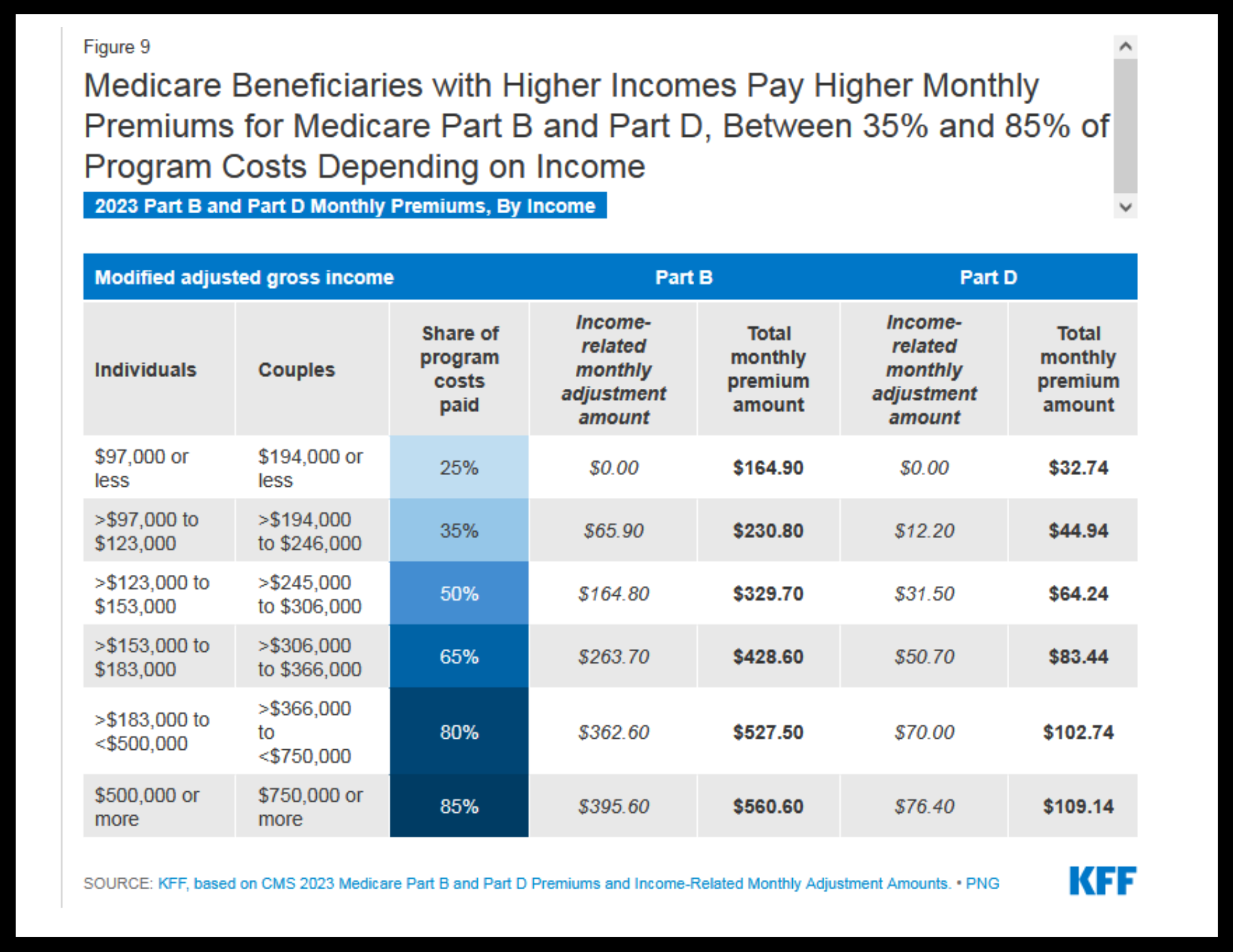

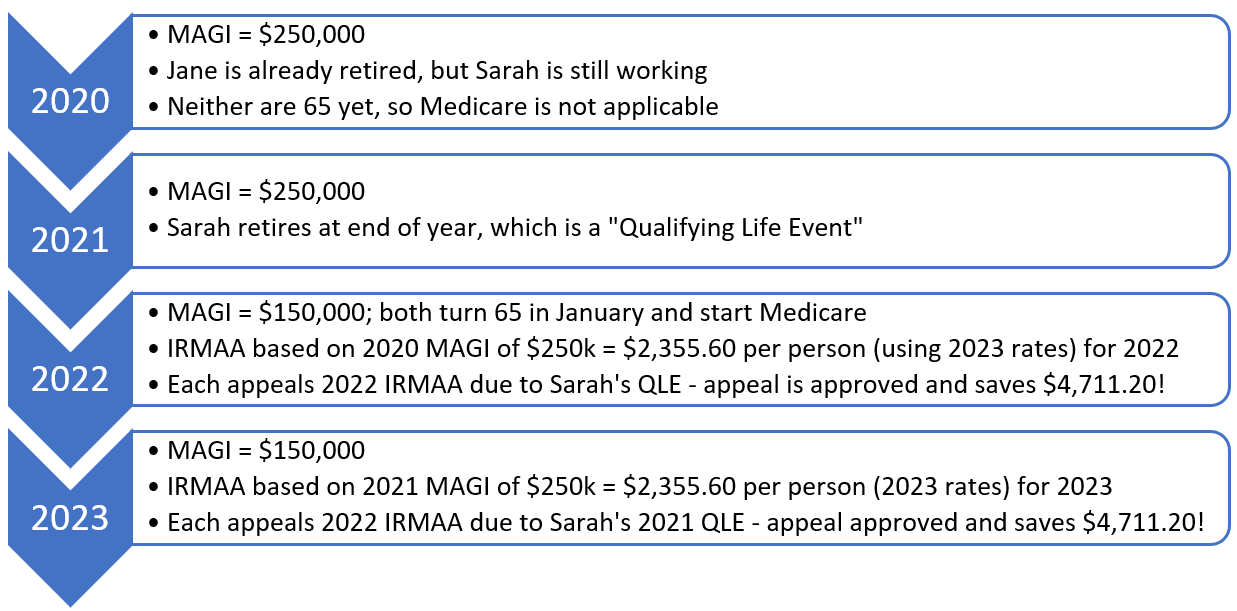

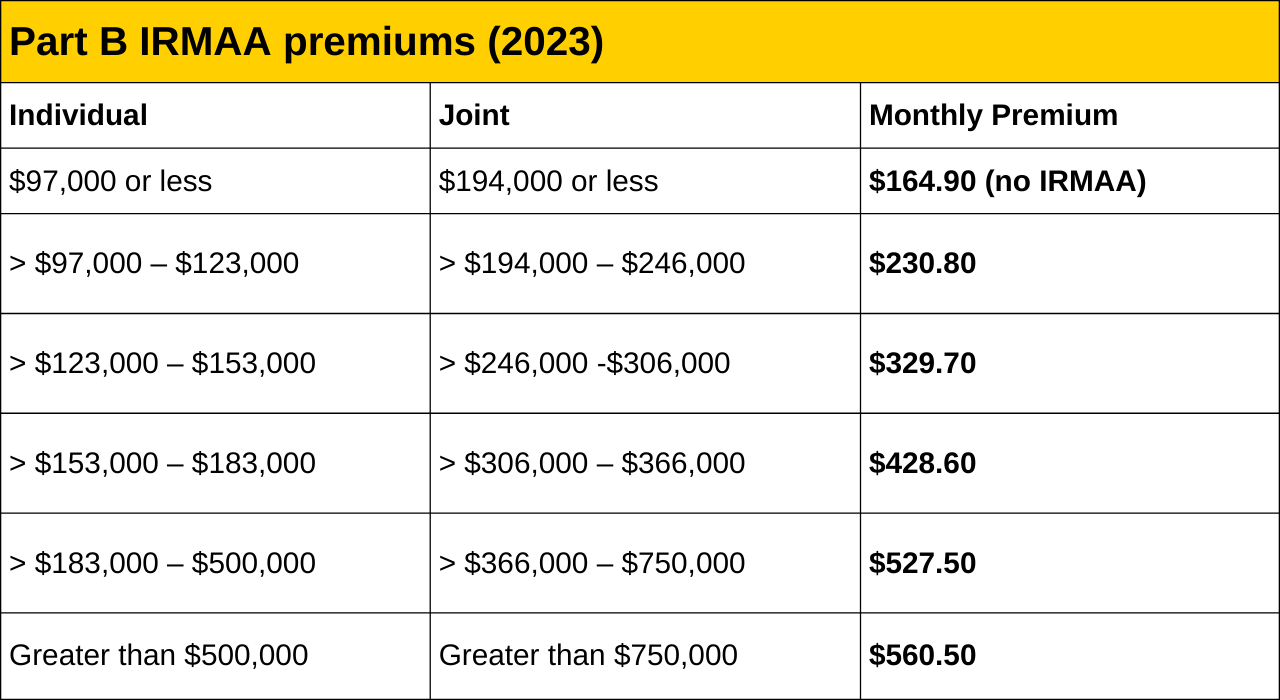

The IRMAA is an additional amount that high-income beneficiaries pay on top of their standard Medicare Part B premium. The IRMAA is based on your modified adjusted gross income (MAGI) from two years prior. For 2025, the IRMAA brackets are as follows: Single filers with an MAGI between $91,000 and $114,000 will pay an additional $65.40 per month Single filers with an MAGI between $114,001 and $142,000 will pay an additional $164.80 per month Single filers with an MAGI between $142,001 and $170,000 will pay an additional $264.20 per month Single filers with an MAGI between $170,001 and $216,000 will pay an additional $363.60 per month Single filers with an MAGI above $216,000 will pay an additional $463.00 per month Joint filers will pay more, with the highest bracket being $578.30 per month for those with an MAGI above $433,000. Understanding the 2025 Medicare premiums and deductibles, including the IRMAA, is crucial for Medicare beneficiaries to plan their healthcare expenses. While the premiums and deductibles may seem overwhelming, it's essential to review your income and adjust your budget accordingly. Remember to review your Medicare plan options during the annual enrollment period to ensure you have the best coverage for your needs. By staying informed and planning ahead, you can navigate the complexities of Medicare and make the most of your benefits.For more information on 2025 Medicare premiums and deductibles, visit the official Medicare website or consult with a licensed insurance agent. Stay up-to-date with the latest Medicare news and updates to ensure you're prepared for the upcoming year.